Prioritizing Energy Efficiency in the MSME Recovery Package

Analysing India’s economic revival packages for fast & green recovery of MSMEs

The Micro, Small and Medium Enterprises (MSME) are the backbone of India’s inclusive growth story, with a GDP share of 30% and 48% in overall exports in FY 2018. They have also led to the creation of 11 crore jobs till date.

Further, the sector also contributed 11-14% in the total energy consumption in FY 2018. The ongoing Covid-19 pandemic has severely impacted the cash cycles of MSMEs, resulting in huge job losses. To revive MSME’s economic condition and enable them to get back to production and workers back to gainful employment, the Finance Minister of India announced a series of stimulus packages under the Atmanirbhar Bharat program. While these relief packages are focused on economic revival, it would be beneficial to understand whether they can be leveraged for investment in energy efficiency by the MSMEs.

Further, the sector also contributed 11-14% in the total energy consumption in FY 2018. The ongoing Covid-19 pandemic has severely impacted the cash cycles of MSMEs, resulting in huge job losses. To revive MSME’s economic condition and enable them to get back to production and workers back to gainful employment, the Finance Minister of India announced a series of stimulus packages under the Atmanirbhar Bharat program. While these relief packages are focused on economic revival, it would be beneficial to understand whether they can be leveraged for investment in energy efficiency by the MSMEs.

The various stimulus packages for MSMEs under the Atmanirbhar Bharat program and their relevance to cleantech fund is described below:

Rs. 3 lakh crores Collateral free Automatic Loans for Business including MSME

As MSMEs have been badly hit due to crisis, to enable them to meet their operational liabilities, buy raw material and reinstate the business, an emergency credit line is provided by the banks and Non-Banking Financial Companies (NBFCs). This credit line is up to 20% of the entire outstanding credit as on February 29, 2020. The borrowers with upto Rs. 25 crore outstanding credit and Rs. 100 crore turn over are eligible for taking loan under this scheme.

The MSME unit with an outstanding credit will in all probability not be in an economically sound condition. Hence, the loan amount’s utilization will be towards getting things operationalized rather than investing in improving the energy performance. This keeps the Rs. 3 Lakh crore collateral-free loan outside the purview of the green fund.

Rs. 20,000 crores Subordinate Debt for Stressed MSMEs

Through this particular relief measure, GOI will facilitate the provision of Rs. 20,000 crore equity support to stressed MSMEs. This support will be in the form of subordinated debt, a type of debt that’s paid after all other debts and loans are repaid, in case of borrower’s default. But the banks get the money for subordinate debts before the shareholders. Functioning MSMEs that are Non- Performing Assets (NPAs) or stressed are eligible for this measure.

As with the previous one, this scheme is not beneficial for availing green funds as MSMEs who are stressed or NPA are eligible, who will direct these funds to operationalize their unit rather than on cleantech.

Rs. 50,000 crore Equity infusion for MSMEs through Fund of Funds

The Venture Capitals (VCs) and Private Equity (PEs) offer funding in the early stage, however, very few provide funding during the growth stage, resulting in MSMEs facing severe equity shortages. This fund thus aims to provide equity funding to MSMEs with growth potential and viability. Under this scheme, the equity infusion will be through Fund of Funds, operated through a Mother fund and few Daughter funds. The Government of India will set up a corpus of Rs. 10000 crore called as the Mother fund. This can then be invested in Daughter funds, where it is expected to mobilize equity of about Rs. 50000 crore or more which can be deployed in the MSMEs. The objective behind this scheme is to help MSMEs expand their size as well as capacity and encourage them to get listed on the main board of stock exchanges. MSMEs with high creditworthiness and a good track record of meeting financial obligations are eligible to get funding under this scheme.

While a rigorous due diligence process will be adopted to disburse funds through this scheme, there is an opportunity to include energy efficiency as one of the process criteria. It can be mandated that a part of the funding disbursed through this scheme has to be utilized for purchasing energy-efficient equipment with a certain threshold provided for each equipment or technology in terms of energy performance. Using these funds for energy-efficient equipment can result in rapid achievement of the scheme’s overall objective, as energy efficiency plays a vital role in improving MSMEs’ competitiveness.

These were some of the main stimulus packages under the Atmanirbhar Bharat scheme. Most of them focus on making the MSMEs operational and bringing their production levels on track with the pre-Covid level. However, the schemes focused on promoting growth and capacity augmentation can be linked with energy efficiency to leverage these schemes’ maximum benefits concerning the MSMEs’ economic viability.

Further, on February 1, 2021, our Finance Minister announced the annual budget that included the Production Linked Incentive (PLI) Scheme for the growth of the manufacturing sector.

Production Linked Incentive (PLI)

The PLI scheme was announced to make manufacturing companies an integral part of the global supply chain, improve their core competence and promote usage of cutting-edge technology within our manufacturing facilities. The scheme aims to create global champions for an Atmanirbhar Bharat and has been announced for 13 sectors, including textile, specialty steel, auto components, and food processing. Through this scheme, the government aims to achieve self-reliance and reduce the country’s imports of goods or products.

This scheme does not take into consideration the investment in energy efficiency out of the total investment while providing incentives, as these incentives are based on incremental sales or investment. If the total incentives are calculated taking into consideration the investment in energy efficiency, a significant uptake in energy efficiency measures in the MSME sector will be observed. If energy efficiency advances in our MSMEs, they can be more competitive and perform well in domestic and international markets. This can result in increased self-reliance both in terms of manufacturing and energy security.

Incorporating Sustainability in Economic revival

Energy efficiency and renewable energy must be an integral component of the stimulus packages for MSMEs. These measures enhance their economic competitiveness by lowering energy bills, sustaining existing jobs and creating new jobs in the energy efficiency service and equipment manufacturing segments. Further, they contribute to India’s Nationally Determined Contributions (NDCs), decrease the country’s reliance on energy imports and release funds to spend in other sectors of the economy.

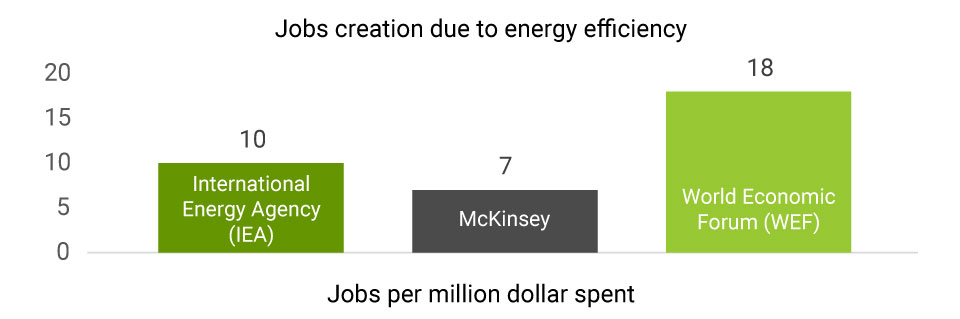

Several organizations, including International Energy Agency (IEA), McKinsey and World Economic Forum (WEF), believe that investments in energy efficiency can create jobs in the energy efficiency service and manufacturing segment. According to McKinsey, government spending on energy efficiency and renewable energy creates 75 and 77 jobs per million, respectively, more than the jobs created from spending on fossil fuels, estimated at 27.

Sustainable energy actions can deliver economic stimulus objectives at scale and speed, as quoted by IEA. Hence, there is a need to well-design our economic recovery packages to leverage or take the support of energy efficiency and renewable energy measures. The existing and future schemes can be modified to give special importance to the energy performance improvement efforts made by the MSMEs availing loan facility.

References:

- Atmanirbhar Bharat Part-1: Businesses including MSMEs (13.05.2020)

- MSME Relief Package (Cleartax)

- New MSME Schemes: PM Economic Package for MSME Sector (GJEPC India)

Written by Shravani Itkelwar with inputs from Deepak Tewari

Shravani is working as a Research Associate in the Industrial Energy Efficiency vertical at AEEE. Her research area focuses on energy efficiency market enablement, institutionalizing building energy data management and low carbon transition of the construction sector. She holds a master’s degree in Renewable Energy Engineering and Management from TERI School of Advanced Studies, New Delhi, and a bachelor’s in Mechanical Engineering.