Cooling is the new hot: Transitioning India to Super Energy-Efficient Room Air Conditioners

Cooling has been linked to economic growth and is defined as a catalyst for good health, well-being, and better productivity for occupants residing in hot climate zones, along with being one of the essential cornerstones for achieving Sustainable Development Goals (SDGs), as per the India Cooling Action Plan (ICAP) 2019.

This blog briefly encompasses the highlights of our study on “Transitioning to Super Energy-Efficient Room Air Conditioners: Fostering ICAP Implementation”, conducted under ongoing project ‘SHEETAL’, supported by Children’s Investment Fund Foundation. This blog provides a proposition for the continual efforts, for ecosystem-level enhancement, to overcome several barriers on different fronts, including market, financial, and enforcement barriers. Overcoming these barriers becomes essential to support the transition to super energy-efficient appliances, achieving overall ecosystem level efficiency gains, leading to a larger goal implementation of ICAP recommendations and identifying pathways to meet India’s Climate Change Commitments. This will also foster India’s transition to super energy-efficient room air conditioners, and thereby contributing to India’s road to Net Zero Energy Buildings.

Background

India is amongst the countries with the lowest access to cooling, with per capita energy consumption levels for space cooling at 69 kilowatt-hours (kWh), compared to the world average of 272 kWh. India has a tropical climate and is experiencing a rapid increase in average temperature, resulting in heat stress that could be effectively countered by room air conditioners (RACs), as they work well under such climatic conditions. However, RACs have a low penetration rate of 7-9% in the Indian residential sector. Despite their low penetration, they still contribute ~40-60% of India’s peak load, as they are used mainly during peak hours of the day, especially in major metropolitan areas, and constitute a dominant share of space cooling energy consumption—around 44% in 2017-18, which is expected to increase up to 50% by 2037-38. It is projected that the RAC stock in households will be ~580 million units by 2037-38, and its market is projected to grow at a compound annual growth rate (CAGR) of 11% in the coming decade. The growth of RACs in the Indian appliance market is connected to multiple factors, including rapid urbanisation, the increasing purchasing power of middle income group consumers, bulk procurement by private or public entities, leading to cost reductions for them, which in turn, drives further demand, increased access to electricity, rising temperatures, and heat stress. Therefore, with the majority of India’s RAC stock yet to come, i.e. 21% by 2027-28 and 40% by 2037-38, and the increasing contribution of RAC to space cooling energy consumption, compounded with lack of access to cooling and rising heat stress, it is imperative for India to address space cooling requirements and provide thermal comfort for all without compromising on its environmental commitments. Hence, there is still a window to improve energy efficiency and develop policies to facilitate the transition towards environmentally-friendly technological interventions to reduce RAC-related space cooling energy consumption and greenhouse gas (GHG) emissions in the future.

Alignment with ICAP

In 2019, the Ministry of Environment Forest and Climate Change (MoEF&CC) launched ICAP, which highlights the extensive dependence on space cooling appliances and provides information on the amount of energy consumed and refrigerant leakage at the end of the space cooling appliance’s lifecycle, in order to contribute to achieving thermal comfort, reduce thermal loads, and enhance space cooling appliances’ energy efficiency. One of ICAP’s recommendations—ratcheting up minimum energy performance standards (MEPS) for RACs—has been extensively discussed in various forums, and there is a consensus amongst civil society, research institutions, and think tanks on the need to ratchet up the current level of MEPS and improve the enforcement of standards and labelling (S&L) programmes in India. Therefore, in alignment with the ICAP recommendations, this report provides insights into the institutional and regulatory frameworks, market transformation strategies, and key initiatives adopted nationally and internationally to increase the performance and promote the use of super energy-efficient RACs. The report also presents detailed information regarding India’s S&L programme and RAC scenario. Furthermore, the report provides recommendations on how to eliminate the identified barriers and move forward, based on the learnings from the review of RAC MEPS adopted in selected countries.

Key Highlights and Observations

The report has provided several observations related to institutional & policy aspect, market scenario, RAC MEPS adopted nationally and internationally; some of those key observations are mentioned below:

Institutional & Policy Framework

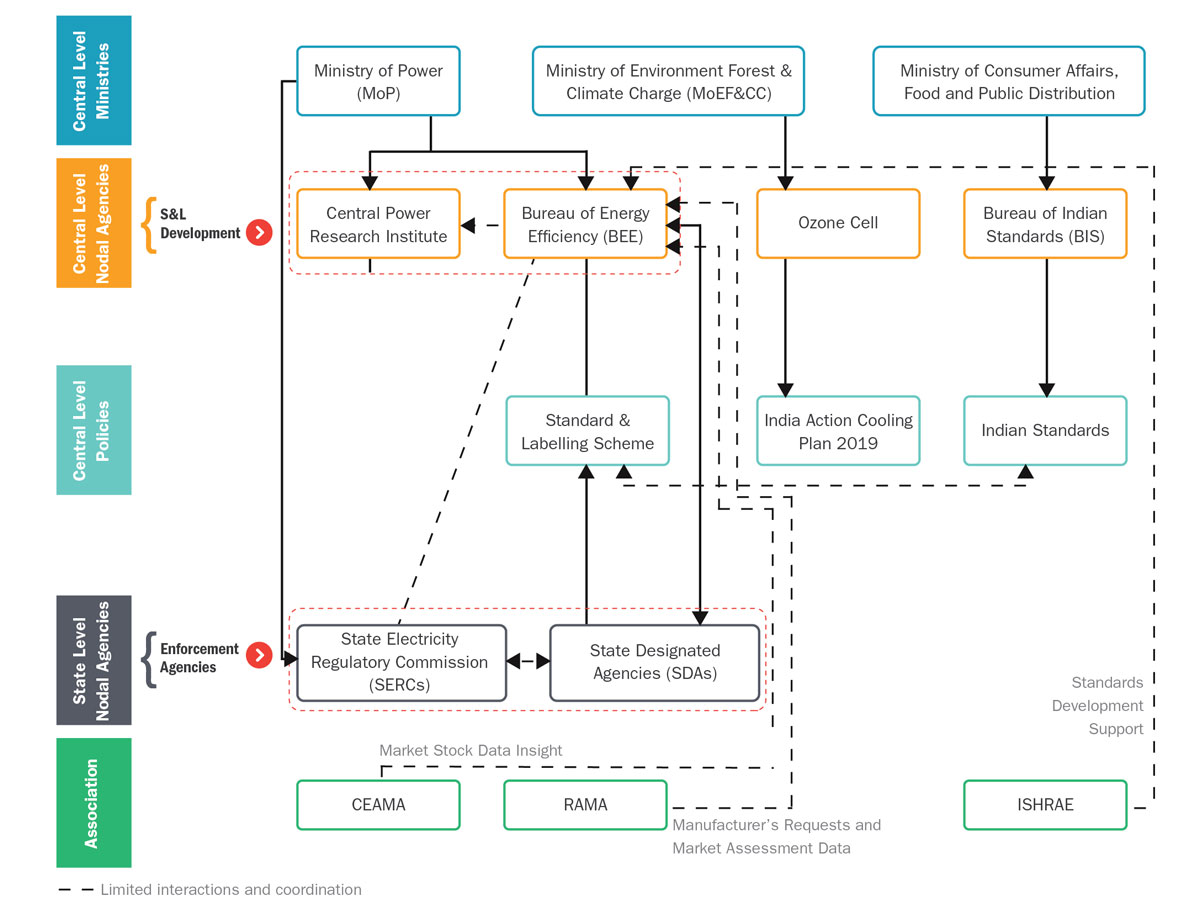

The report has mapped various ministries, regulatory bodies, and associations and their roles in increasing appliance efficiency in India as shown in Figure 1.

Figure 1: Institutional framework governing S&L of Appliances in India

Figure 1: Institutional framework governing S&L of Appliances in India

These organisations work independently on different aspects related to RACs and provide various recommendations to the government. Hence, post policy development, it becomes a challenge to coordinate the efforts between different governmental entities to synchronize efforts for the implementation of the policy. Therefore, the report has recommended establishing a more permanent mechanism to coordinate various actions, in order to achieve the ICAP recommendations.

Market Aspect

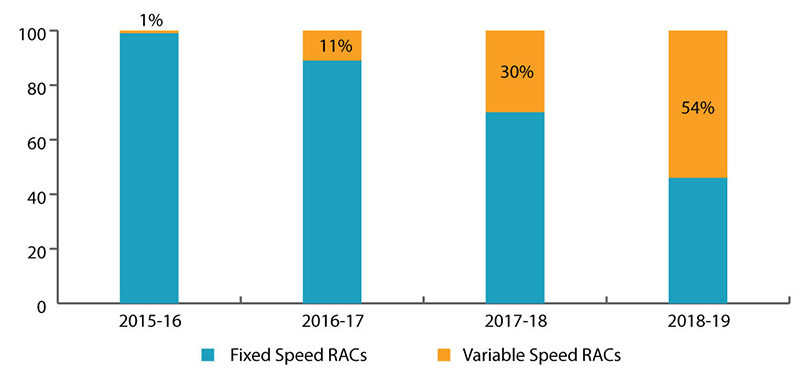

The report has highlighted that, in 2015-16, the variable speed RAC market share was less than 1% in India, which increased to 54% of total sales by 2018-19; in contrast, the share of fixed speed RACs decreased from around 99% in 2015-16 to 46% in 2018-19 shown in Figure 2.

Figure 2: Market share of fixed and variable speed RACs

Figure 2: Market share of fixed and variable speed RACs

MEPS Comparative

To compare the RAC MEPS improvement rate of other countries to that of India, the report examines and provides a comparison of the RAC MEPS adopted by select countries – Japan, South Korea, Brazil, and China to that of India as summarised in Table 1.

Table 1: Energy efficiency improvement rates – country wise

| Country | Rated capacity/ type | Period considered (number of years) | Base MEPS | Revised MEPS during the standard upgrade | Annual energy efficiency improvement rate in RAC MEPS (approximate) |

| Japan | < 3.2 kW | 2005-2010 (5) | 4.90 (COP in 2005) | 5.8 (APF in 2010) | 3.43% |

| South Korea | < 4.0 kW | 2012-2021 (9) | 3.37 (CSPF in 2012) | 4.5 (CSPF in 2021) | 3.27% |

| Brazil | < ~2.5 kW | 2022- 2025 (3) | 3.14 (CSPF expected in 2022) | 3.5 (CSPF expected in 2025) | 3.68% |

| China | < 4.5 kW

VSD & FSD |

2020-2022 (2) | 3.70 | 5.00 (SEER in 2022) | 16.25% |

| < 4.5 kW

VSD |

2013-2020 (7) | 4.30 (SEER in 2013) | 5.00 (SEER in 2020) | 2.18% | |

| < 4.5 kW

FSD |

2010-2020 (10) | 3.20 (EER in 2010) | 3.70 (SEER in 2020) | 1.46% | |

| India | Unitary RAC | 2018-2021 (3) | 2.5 (ISEER in 2018) | 2.7 (ISEER in 2021) | 3.92% |

| Split RAC | 3.1 (ISEER in 2018) | 3.3 (ISEER in 2021) | 3.18% |

Recommendations

The report maps and analyses the existing barriers in the Indian RAC and appliance sector and provides detailed recommendations to ratcheting up RAC MEPS and enhance the appliance ecosystem that could be adopted by key stakeholders to circumvent those barriers in the near future. A glimpse into the detailed recommendations mentioned in the report is shown below:

Table 2: Identified barriers and recommendations

| Barriers and policy gaps | Recommendations |

| To support the ratcheting up of RAC MEPS | |

Regulatory barriers: Frequent standards revision Regulatory barriers: Frequent standards revision |

|

Market barriers: Need for innovative business & financial models Market barriers: Need for innovative business & financial models |

|

Market barriers: Absence of incentives/tax rebates for efficient products Market barriers: Absence of incentives/tax rebates for efficient products |

|

| To enhance the appliance ecosystem | |

Enforcement barriers: Limited SDA capacity Enforcement barriers: Limited SDA capacity |

|

Enforcement barriers: Limited testing capacity Enforcement barriers: Limited testing capacity |

|

Financial barriers: Absence of financial mechanisms to promote RAC R&D infrastructure Financial barriers: Absence of financial mechanisms to promote RAC R&D infrastructure |

|

Way Forward

With the need of the hour to ratchet up RAC MEPS in India, all eyes are on India to see how it executes this ICAP recommendation. Based on the literature review of India’s policy, regulatory, and institutional framework for appliances and the learnings gathered from the review of MEPS adopted in selected countries, it is clear that India’s S&L programme is robust, well-designed, and highly impactful. However, there are some challenges and issues related to its consistent and coordinated implementation; there is substantial scope for improvement in India’s S&L programme and its implementation, from coordinating the efforts at the central level with state and non-state actors, to supporting SDAs in enforcement and implementation. Furthermore, the availability of super energy-efficient technologies nationally and internationally as a result of the GCP offers India a unique opportunity to ratchet up its RAC MEPS. The GCP announced two winners in April 2021, which both met the prize criteria of 5 times lower climate impact compared to the average RACs available on the Indian market, indicating the global market is continuing to innovate, and the efficiency of all products is increasing, as RAC costs continue to fall. Consumer behaviour studies could also provide a way forward to better understand consumer perceptions, barriers, and the demand scenario, in order to tailor strategies to current end-user requirements. Furthermore, with the new S&L notification and MEPS target for RACs in India yet to be developed beyond 2023, this could be the first significant policy action post ICAP development and could position India as a nation that is upholding its commitment through strong action and staying true to the course of action established in ICAP.

For more information please read ‘Transitioning to Super Energy-Efficient Room Air Conditioners: Fostering ICAP Implementation’.

Written by Srishti Sharma and Akhil Singhal with inputs from Tarun Garg based on insights and information captured during the development of the Transitioning to Super Energy-Efficient Room Air Conditioners: Fostering ICAP Implementation Report.