The Post-Pandemic Story of the Indian E-Mobility Sector

India’s transport electrification story is woven with the threads of ‘shared, connected and clean mobility’. The demand incentives under Faster Adoption and Manufacturing of Electric Vehicles (FAME) II scheme were introduced to support the uptake of electric vehicles for public transport and commercial use. However, as the nation went into lockdown, and public passenger mobility hit zero, it impacted the budding EV industry. Development of public transport, once viewed as a formidable solution towards sustainable transport has now hit a fundamental snag in the form of the shift towards increased private ownership. As the economy is recovering after a pause, the way ahead for electric mobility needs to be rethought.

Restructured priorities of the Government of India for stimulating a pandemic-ridden economy, raises an important question regarding the future for e-mobility in India. E-mobility had been the ‘apple of the policy maker’s eye’ and actions were supportive to create a viable market for mass-scale EV adoption [1]. The momentum was reflected in successive policies and budgets that were rolled out by the Government of India. To illustrate the same, last year the government came up with changes to import duty rates and tax benefits for EVs in the Union Budget 2020. Contrastingly, the latest edition of the budget hardly mentions EV. These factors prompt an examination of post pandemic mobility trends and specifically the role of e-mobility.

Behavioral trends in Indian Mobility

Rising health concerns among the public have led a general shift towards private modes of transport. In recent surveys on modal share comparison between pre and post COVID-19 scenario, a decrease in public transport usage was observed in metro cities [2]. The increase in demand for private vehicles need not necessarily translate to gains for e-mobility. This is illustrated by the following two arguments:

- Affordability of an EV is important to the price sensitive Indian consumer, who is already experiencing a reduction in income. For a private use case with less travel, EVs with their high upfront cost are not competitive as a preferred choice for purchase.

- A positive externality during the lockdown was the significant uptake of non-motorised transport such as cycling. This has renewed interest in construction of dedicated cycling paths in cities such as Hyderabad and Bengaluru. Thus to hypothesise gains for e-mobility is misplaced.

Budget Perceptions and FAME

The run-up to the budget had stakeholders voicing their recommendations to support the FAME-II EV fleet. Due to the pandemic, a two-year extension on the scheme was proposed by EV manufacturers. They also recommended including EVs under the priority lending sector to boost financial access. Change in the inverted duty structure on Li-ion batteries to be made equal to 5% GST as on EV chargers was sought [3]. Acknowledging the shift in demand for the two and three-wheeler vehicle segment, the industry felt that incentives should be higher. The slab on 20,000 INR per kWh of battery that is currently applicable to e-buses was sought to be extended to the smaller vehicle segments as well. The industry was also expecting schemes to encourage charging infrastructure.

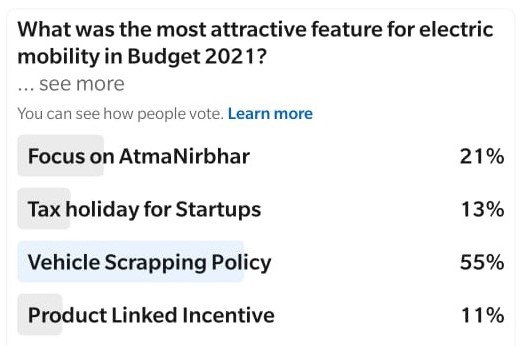

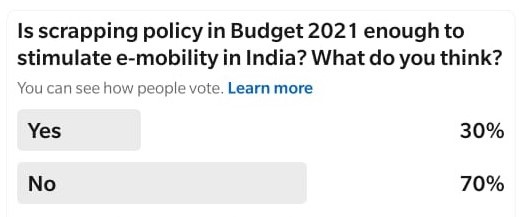

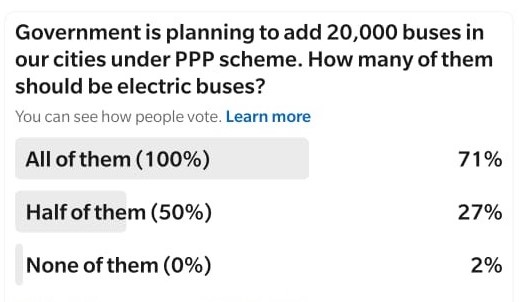

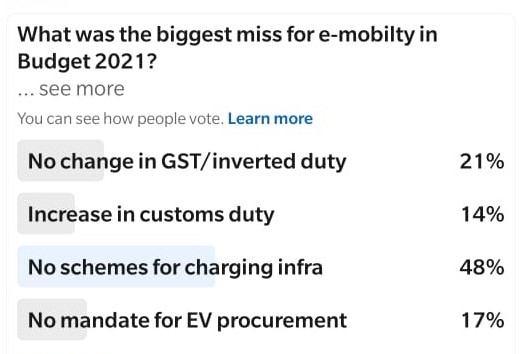

To understand how the budgetary provisions weighed against the expectations of the EV community, AEEE conducted polls[ The poll questions 1-4 received 53, 132, 142 and 107 responses respectively] via social media. A set of questions were designed to gauge public response with respect to what the budget implies or could imply for the future of e-mobility in India. The following section is a summarisation of the responses received for the poll questions that were asked:

On the question regarding the most attractive feature for e-mobility mentioned in this budget, more than 50% of the respondents felt that the new vehicle scrappage policy stands as the winner. Vehicle scrapping policy would work as an indirect push to e-mobility adoption and in the long term benefit the e-mobility ecosystem. The respondents felt that the scrapping policy was long pending and the government’s approach is to let the market forces determine the consumer choices. An attempt to pit EVs as the more attractive buying option by making ICEs unviable seems to be the intention.

As a follow-up to the above question, we posed this poll question to see if scrapping policy is enough for the recovery of e-mobility sector. Having ascertained scrapping policy as an attractive option, we intended to gauge if the respondents thought it to be effective enough by itself. A clear majority sided with the opinion that the scrapping policy would do little by itself to stimulate e-mobility in India. The measure is seen more as a positive externality rather than a viable catalyst in itself. In the short run, as the passenger demand is rebounding, the question is how the progress in electric vehicle (EV) manufacturing, and sales can be sustained.

The budget identified investments in urban bus fleets as a focus area, and iterated the plan to launch 20,000 new buses. As a reflection of stakeholder enthusiasm, this poll question represents the importance of electrifying public intra-city bus fleets. 71% of respondents were of the opinion that the new city buses must be electric. Under the aegis of FAME-II, financial support is offered to 7000 electric buses. For the new city buses to go electric, the coverage under FAME scheme needs to be extended to ensure that the operation is financially viable for city transport operators.

We also asked about the biggest missed opportunity in Budget 2021, and majority of respondents felt that the budget failed to encourage charging infrastructure. The line of thought that charging infrastructure cannot be an afterthought for uptake of EV is reflected in this poll. Under the path for green recovery, IEA has also emphasised that investments in charging infrastructure can be useful in creating jobs. It will be a critical miss for Indian e-mobility to not have sustained efforts in place to roll out charging infrastructure. The pandemic has centered focus on sustainability and environment like never before and the possible momentum of EV uptake must not be short-handed by lack of adequate charging infrastructure.

In conclusion, the pandemic has altered the roadmap for e-mobility in India. Shifting trends in consumer preferences, and changing priorities of the governments warrant a new discussion on the path Indian e-mobility must undertake. Critical decisions are to be made on the investments henceforth. Industry will have to regulate focus between public and private modes of transportation. Innovative ways to finance e-mobility in India must crop up in order to ensure that the momentum for sustainable transport stands unfettered in the face of a pandemic or otherwise.

References and Bibliography

[1] NITI Aayog & World Energy Council. Zero Emission Vehicles (ZEVs): Towards a Policy Framework, 2018.

[2] TERI. 2020. Impact of COVID-19 on Urban Mobility in India: Evidence from a Perception

Study. New Delhi: The Energy and Resources Institute.

[3] FICCI. 2021. ‘EV industry seeks higher incentives, FAME II scheme extension in Budget’, 28 January 2021, http://www.ficci.in/ficci-in-news-page.asp?nid=28440 (accessed on 7 February 2021).

Levi-Faur, David. “Regulatory Capitalism.” In Regulatory Theory: Foundations and Applications, edited by DRAHOS PETER, 289-302. Acton ACT, Australia: ANU Press, 2017. Accessed February 6, 2021. http://www.jstor.org/stable/j.ctt1q1crtm.26.

(Union Budget, Ministry of Finance, Government of India 2021)

Varun BR and Chandana Sasidharan are working in Power Utility and Electric Mobility vertical of AEEE. While Varun is studying policy aspects of electric mobility, Chandana’s research is focused on charging related aspects of electric vehicles.