What Budget 2021 means for the future of DISCOMs in India?

Introduction

DISCOMs should be considered the unsung heroes of Covid-19 pandemic for ensuring power supply to health care and enabling millions of people to work from home. Even with the steep fall in billing and disruption to their cash flows, Indian DISCOMs did not compromise on the supply of power to the end-users. The increasing unpaid dues from consumers aggravated the financial challenges of DISCOMs and interrupted the payments to power generators up the supply chain. The central government announcement of a special relief package of ₹ 900 Billion for the DISCOMs in India [1] was a timely move to ensure the sector’s financial viability in an unprecedented situation.

The Covid-19 pandemic brought about an unprecedented situation across the globe, severely affecting the operation of many businesses. The Indian economy was also drastically affected by the strict lockdown measures imposed by the government. This led to a significant reduction in electricity consumption as the industries and commercial establishments were shut down. This, in turn, resulted in a drastic fall in the revenue of electricity distribution companies (DISCOMs) in India, exacerbating their pre-existing poor structural challenges.

The budget 2021, curated for a sustainable recovery of the economy continues to recognise electricity distribution as a critical link to power sector recovery. The budget proposes ground-breaking reforms to transform the struggling DISCOM ecosystem focusing on, introducing retail competition, and infrastructure creation. The result-linked power distribution sector scheme with an outlay of ₹ 3 Trillion is expected to revolutionise electricity distribution in the next 5 years. Shri. RK Singh, Minister of Power and Minister of New and Renewable Energy) has indicated that the disbursement of allocated funds is linked with following the implementation of smart meters and submission of roadmaps to reduce the overall (AT&C) losses by the DISCOMs [2].

Focus on Smart Meters

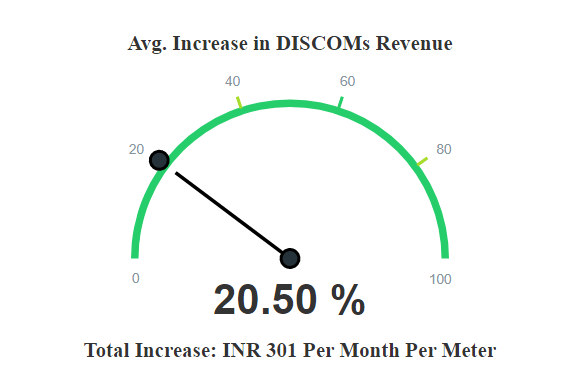

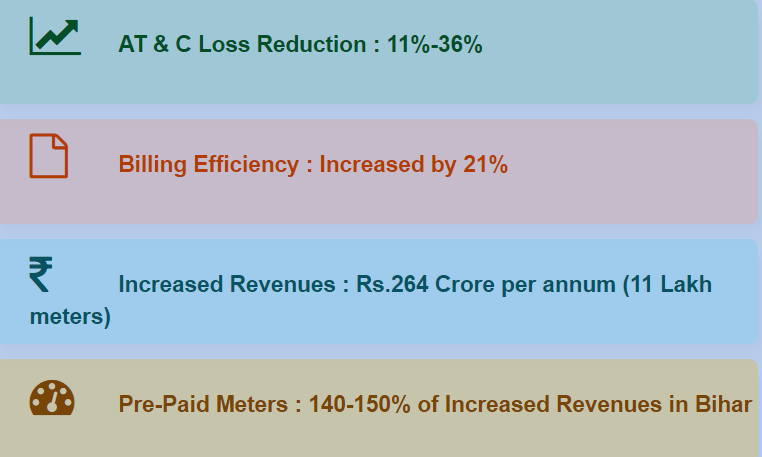

The government has been unwavering in the policy signal on promoting the adoption of smart metering in the power sector. Energy Efficiency Services Ltd. (EESL) is leading the initiative of Smart Meter National Program (SMNP) in India that aims to replace 25 crore conventional meters with smart meters [3]. According to the SMNP dashboard [4], the program has yielded multitude of benefits including improved billing efficiency and reduction of AT&C losses. This resulted in significant improvement of revenue generation for the DISCOMs; data for 11 lakh meters resulted in an aggregated revenue increased by ₹ 264 crore/annum. Statistics shows that the implementation of smart meters has resulted with improvement in DISCOMs’ revenue generation by 20.5% (₹ 301/month/meter), billing efficiency improvement by 21%, while the reduction in AT&C losses is between 11%-36%. The state of Bihar witnessed 140-150% improvement in revenue collection through the implementation of prepaid meters.

Figure 1: Improvement in revenue generation of DISCOMs

Figure 1: Improvement in revenue generation of DISCOMs

Figure 2: Benefits from SMNP

Figure 2: Benefits from SMNP

While mandating the implementation of smart meter is a progressive move, smart meters should not be reduced as tools for making bill payments easier. Benefits from smart meters are not just limited to improved billing efficiencies or reduction in AT&C losses. Smart meters with appropriate functionality enable utilities to gain better visibility of the network. The humungous amount of energy data from the meters is resourceful for the efficient operation of the network. If used effectively, smart meters can unlock the unexplored potential from demand side resources.

Delicensing of electricity distribution

Another interesting development that came out from the Budget 2021 is the government’s plans for delicensing of electricity distribution sector to end the existing monopolies. This will encourage retail competition [2] and empower consumers to choose their electricity service provider. In telecom sector, the end of monopolies has altered the industry. While the framework for delicensing of electricity distribution is still awaited, implementation of such measures is an uphill task. One of the primary requirements is the separation of charges related network infrastructure and the supply of energy. This ‘carriage and content’ separation, though not a new topic of discussion might not be far from reality now. Mumbai had been a hotbed in India for power portability experiments, allowing consumers to switch from one power provider to another [5].

The birth of electricity retail competition could cause a paradigm shift in the operational model of DISCOMs, transforming them from an electricity buyer-supplier to network/system operators. Competitive Electricity Providers (CEP) in retail markets can bring down electricity costs and pass the savings to consumers. Proliferation of distributed energy resources like rooftop solar, electric vehicles and smart appliances are drivers that encourage DISCOM business model transformation making them resilient for future. This wave of change resonated with the global trend of decentralisation and democratisation of the grid which is evolving from a traditional centralised generation.

Empowering the consumer

Giving consumers the right to select the energy provider can go a long way, empowering the consumer to have a voice on deciding his/her energy mix as well. A good example for this would be the Consumer Choice Aggregation (CCA) programs which allow consumers to customize their energy portfolio. The environmentally conscious consumers have the ability to incorporate more renewable energy sources into their consumption that will significantly impact the upstream power procurement decision of the utilities and force them to make greener choices. This will ultimately support the Nation’s ambitious targets for renewable generation and ensure access to clean electricity.

Indian regulators can learn from the experience of utilities in Maine, USA on CEP and CCA. The law for restructuring of electric utility in Maine was passed in 2000, which provided the consumers in Maine the ability to choose their electricity supplier [6]. The restructuring process developed a competitive retail market for electricity supply and CCA empowered the consumers to make decisions about both their supplier and energy mix.

The road ahead is not easy

The true test for progressive reforms is in its successful implementation. As electricity is a concurrent subject, and in a federal system the legislative authority of the central government comes with checks and balances. States are the custodians for the regulatory framework governing DISCOM operation. Building a political consensus among different states for electricity reforms is a Herculean task. Lack of harmony in centre-state relationship hinders the implementation of reforms in the power sector. Inability of the Centre to reconcile with the State’s differences on the subject will prolong a stalemate. It is imperative that the decision makers arrive at an agreeable consensus to realize the potential benefit for the common man.

References

[1] Economic Times: Energy World, “Bailout package of Rs 90,000 crore much-needed “oxygen” for discoms, paves way for reforms: Industry,” 13 May 2020. [Online]. Available: https://energy.economictimes.indiatimes.com/news/power/bailout-package-of-rs-90000-crore-much-needed-oxygen-for-discoms-paves-way-for-reforms-industry/75722429.

[2] Economic Times, “Will delicense discoms to end monopolies: RK Singh,” 03 Feb 2021. [Online]. Available: https://economictimes.indiatimes.com/industry/energy/power/will-delicense-discoms-to-end-monopolies-rk-singh/articleshow/80655717.cms?from=mdr.

[3] Energy Efficiency Services Ltd., “Smart Meter National Program,” [Online]. Available: https://www.eeslindia.org/smnp.html#:~:text=Smart%20Meter%20National%20Programme%20aims,tool%20in%20power%20sector%20reforms..

[4] Energy Efficiency Services Ltd, “National Smart Meter Program Dashboard,” [Online]. Available: https://smnp.eeslindia.org/.

[5] News 18, “Mumbaikars to enjoy power portability, can now choose between Tata, Reliance,” News 18, 2014. [Online]. Available: https://www.news18.com/news/india/mumbai-discoms-670634.html.

[6] Maine Public Utilities Commission, “What Should Consumers Know About Competitive Electricity Providers,” [Online]. Available: https://www.maine.gov/tools/whatsnew/index.php?topic=puc-faq&id=454603&v=article.

First Author: Ishan Bhand, Research Consultant, Power Utility & Electric Mobility

Second Author: Chandana Sasidharan, Senior Research Associate, Power Utility & Electric Mobility

Chandana and Ishan work in the Power Utility and Electric mobility vertical. They are currently researching on the Role of Energy Efficiency and Demand side management in facilitating a sustainable transition of Indian power grid.