Charging two and three-wheelers is the big game

India is a country that loves traveling on two-wheelers and three-wheelers. The electrification of transportation in India is not just a story limited to electric cars in the cities, it’s much more. Undoubtedly, electric two-wheelers(e-2W) and three-wheelers (e-3W) have a massive role in taking electric mobility to every nook and corner. The e-2Ws and e-3Ws are low hanging fruits for clean mobility in India, based on the market readiness, cost-competitiveness, ease of charging, and emission reduction potential (NITI Aayog & Rocky Mountain Institute, 2017).

The e-2W and e-3W segment creates market opportunities in three distinct areas: vehicle manufacturing, mobility services, and charging services. Not surprisingly, e-2W and e-3W manufacturing and fleet services have generated a lot of interest. For supporting the widespread rapid commercial adoption of these Light Electric Vehicles (LEVs), proper planning and establishment of public charging facilities is critical. The third aspect provides a leapfrog opportunity for India to be the trailblazer for setting up innovative charging facilities. AEEE undertook a study that aims to facilitate the establishment of ubiquitous charging facilities for commercial e-2W and e-3W fleets in Indian cities.

Kirana shop charging for two-wheelers

Renting e-2Ws is popular in some Indian cities and towns. Electric bike taxi services such as Ola Bike, UberMOTO, and Rapido and bike rental fleets like Bounce, Drivezy, and Vogo are popular means in cities. Platforms like Yulu, Mobycy, and Mobike provide last-mile connectivity services with e-2Ws. Both food and grocery delivery fleets are also benefiting from electrification of their fleets. The e-2Ws used in commercial operations are mostly electric variants of low-speed scooters.

The choice of charging method depends on the preference of the fleet operators. Bounce is a market leader in setting up battery charging facilities at local Kirana stores, as shown in Figure 1. Most e-2W batteries are detachable, making battery swapping a suitable option. The e-2W batteries are lighter in weight and easier to lift manually. Battery charging is easily done at the site in a couple of hours, and the shop owner has a chance to make extra income from the swapping service. e-2W manufacturer Ather has also tied up with local shop owners to set up vehicle charging points.

Figure 1: Battery swapping station set up for e-2W fleets

Figure 1: Battery swapping station set up for e-2W fleets

Battery swapping for e-rickshaw fleets

e-3Ws will play a central role in achieving “shared, connected, and electric” mobility in India. e-rickshaws are popular than e-autos, which are new in the market. Mobility service providers like SmartE and Ola electric use e-rickshaws to assist in the first-and last-mile connectivity from metro stations. Though the segment mostly uses lead-acid batteries, there is an increasing trend of retrofitting e-rickshaws with lithium-ion batteries. The reduction in charging time reduces downtime and increases savings for the fleet operators.

Battery swapping is most suited for operating these fleets, but the weight of the battery complicates the swapping process. A 3 kWh battery of passenger e-rickshaws weighs at least 20 kg. Lithion Power offers assisted two-person operation at their swapping stations. Sun Mobility has taken another approach to solve the weight problem by designing battery packs that can be easily lifted. More than one battery pack is used in each e-3W. In a swapping facility, multiple batteries are charged at the same time in stack chargers, as shown in Figure 2.

Figure 2: Stack charger for e-3W batteries at a swapping facility

Logistics fleets prefer plug-in charging

Grocery delivery fleets like Grofers, and BigBasket have been the first in line to transition to electric goods carriers. Companies like Amazon and IKEA are committed to use e-3Ws for deliveries in India. The e-3W goods carriers have larger and heavier batteries than the e-3W passenger vehicles. The increased weight complicates the swapping process, hence not many fleet operators prefer this option. Only Gayam Motor Works is an EV manufacturer with e-3Ws with relatively smaller capacity batteries has set up swapping stations in the city to support their operations.

However, when it comes to logistics fleets the operational pattern of the fleets is an advantage . There is a window of opportunity to undertake charging at mid-day when the vehicles are not in service. DOT is a purely electric logistics fleet operator who operates e-3W fleet with 1.5 charge cycle in a day: one full cycle overnight and a half cycle at midday. eFleet Logix, another logistics support partner for e-commerce businesses also operate in the same charging pattern. However, the real estate foot print for plug-in charging facilities is high.

One-size-fits-all doesn’t work

In a nutshell, the choice of charging method depends on fleet’s operational pattern and vehicle battery characteristics. Setting up charging for one vehicle is easier than one for multiple vehicles. The high cost of space rental is a deterrent for centralised charging facilities. Swapping is a good option for minimising vehicle downtime with least area footprint. However, as the weight of the battery increases, lifting batteries for swapping becomes cumbersome. Logistics fleet operators capitalise on the idle time of vehicles for recharging and prefer central captive charging facilities as an effective option.

Operation of e-2W and e-3W fleets is possible through plug-in charging and battery swapping solutions which could serve both individual or multiple vehicles. Individual EV charging or battery swapping facilities can be easily set up in Kirana stores. Multiple EV charging facilities or stack battery charging facilities can be set up in parking spaces in metro stations, malls, shopping centres, hospitals, schools, etc. Battery swap only facilities are like vending machines for batteries which can be set up anywhere without the requirement of an electricity connection at the site. In these type of facilities there is no battery charging at the site, and charging could be done in another centralised facility.

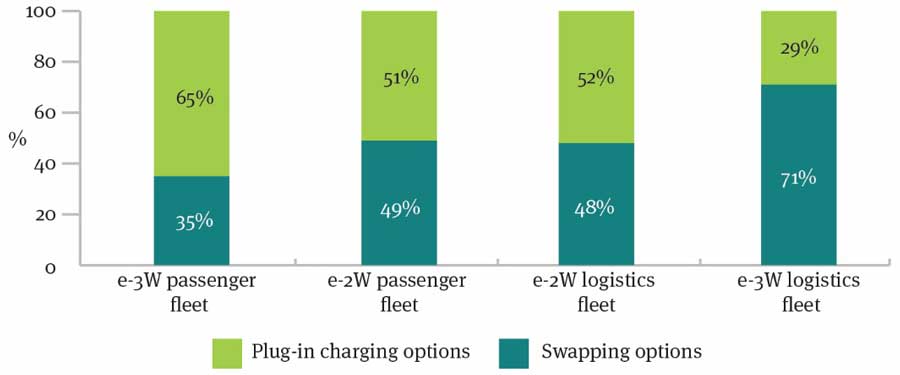

To understand the differences in preferences, AEEE team surveyed the fleet operators, and the results are presented in Figure 3. From the survey results, it is evident that for e-2W fleets, both battery swapping and plug-in charging are equally preferred by the fleet operators. For e-3W passenger transport, battery swapping is preferred over plug-in charging, whereas in the case of logistics transport, the reverse holds true.

Figure 3: Preferences of fleet operators

Figure 3: Preferences of fleet operators

The need of the hour is to design and implement cost-effective, scalable, and home-grown charging solutions that can meet the charging requirements of this EV segment. The AEEE study has identified five types of public charging facilities for e-2W and e-3W fleets, each with its own unique characteristics. Their uptake for different fleets depends on how well they fit into the fleet operations. The research also shows that parameters such as vehicle downtime, cost of rental space, infrastructure cost, electricity cost, ease of getting an electricity connection, and scalability should be part of the evaluation of the potential charging solutions.

For more details please refer to Charging India’s two and three wheeler transport

Written by Chandana Sasidharan, Senior Research Associate, Power Utility and Electric Mobility Vertical